Europe is on the cusp of a transformative era. The Green Deal needs to deliver on ambitious climate goals while ensuring continued prosperity. European economic integration was built with steel, the backbone of Europe’s growth, contributing billions to the economy and providing jobs to millions of Europeans. As EUROFER, the European Steel Association, we believe the future of a green Europe can only be forged with European steel.

The future of ‘Green Steel’ begins here in Europe and will become a global reality if we support our own industrial ecosystems throughout this transition. Europe-made steel has a strategic role and enables a net-zero economy, but today it faces strong headwinds from the energy crisis, unfair international competition, and growing unilateral carbon costs. Ensuring the enabling conditions for the transition of energy-intensive industries -- such as steel -- that are essential for clean tech value chains must be at the top of today’s and the post-2024 EU agenda. We call on policy makers to prioritize the following five pillars:

The European steel ecosystem provides 306,000 direct jobs across 22 EU Member States and supports over 2.2 million indirect and induced jobs in the EU, creating €143 billion of Gross Value Added per year across sectors. Steel is a pillar of European prosperity, and our industry a standard bearer of the EU’s high labour and ethical standards. Beyond numbers, steel is the foundation of most EU clean value chains, ensuring resilience in a context of geopolitical uncertainty. From trains, cars, bikes, windmills, solar panels, to critical infrastructure and everyday items, steel is the core of the better world we aim to build.

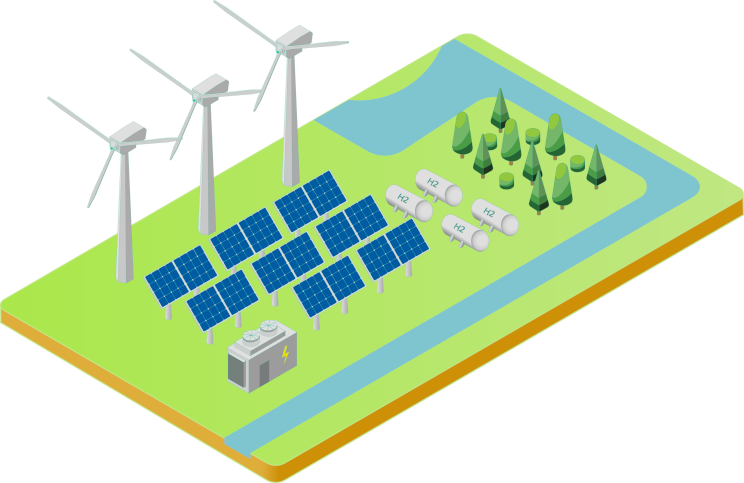

Innately circular and 100% recyclable, steel is not just a material, it is a testament to Europe’s resilience, innovation, and commitment to sustainability. With over 3,500 grades of steel – 75% of which have been developed in the last two decades – European steel is stronger, lighter, and greener than ever before. The EU boasts an 88% steel recycling rate, while in 2021 more than half of our steel production was made from recycled steel, positioning European producers as global leaders in circular steel. Over 60 low-carbon steel projects are planned or underway across the EU, aiming to reduce CO2 emissions by 81.5 million tonnes annually by 2030. The first ones should start operations by 2026. With the right conditions in place, the future of the clean tech industry will be made in Europe, and through continuous investment in decisive technologies, we pave the way for a net zero future.

Brussels, 24 February 2026 - Europe’s energy-intensive industries have set out a series of proposals to ensure that the EU’s upcoming Electrification Action Plan delivers on its objectives to stimulate and boost electricity consumption in industry. In a joint position paper, industries warn that persistently high electricity prices risk undermining industrial competitiveness and decarbonisation efforts. They call for a policy framework that will enable EU industry in pursuing decarbonisation and industrial competitiveness.

Energy-intensive industries (EIIs) provide direct employment to around 2.6 million people in the EU and represent the foundations of critical and strategic value chains for the EU economy and society. The current economic and energy outlook of the European Union is making investments in electrification and the continued business operation of our sectors at serious risk, should the energy-cost challenge not be solved.

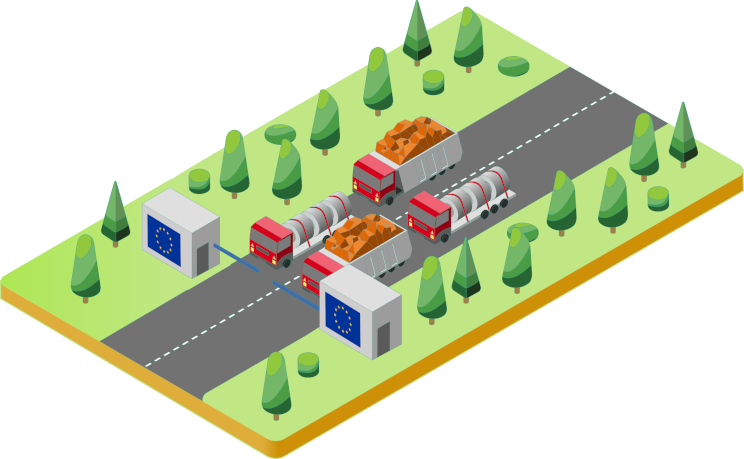

Brussels, 20 February 2026 – EU steel exports to the United States fell by 30% in the second half of 2025 compared to the same period in 2024, after the imposition of 50% tariffs according to new Eurostat data. The expansion of the U.S. tariff regime to include downstream steel-intensive products, such as machinery and equipment, is expected to amplify its impact on both EU steel producers and their customers. The European Steel Association (EUROFER) said the figures underscore the need for any EU-US trade agreement to be fair, balanced and enforceable.