Press releases » EU-U.S. trade deal must preserve 3.8 million tonnes of tariff-free EU steel exports to the U.S. and stop steel deflection to the EU, says EUROFER

EU-U.S. trade deal must preserve 3.8 million tonnes of tariff-free EU steel exports to the U.S. and stop steel deflection to the EU, says EUROFER

Downloads and links

Recent updates

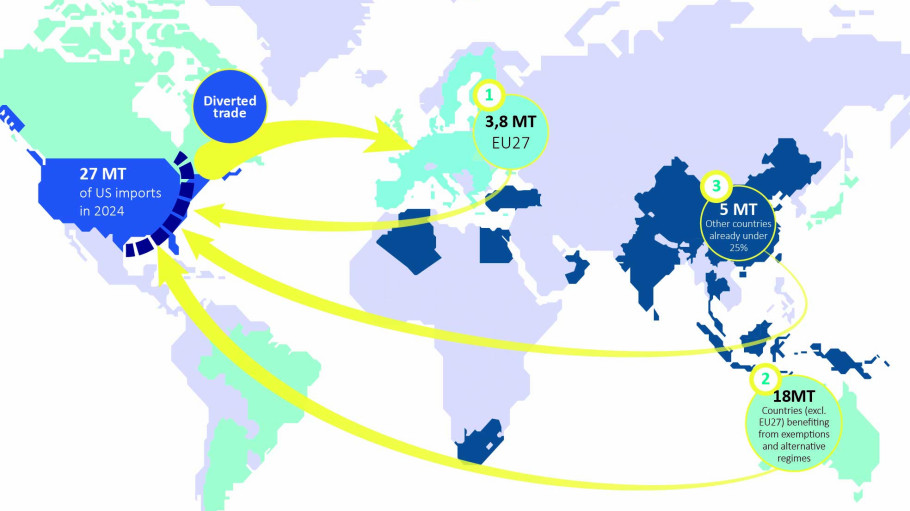

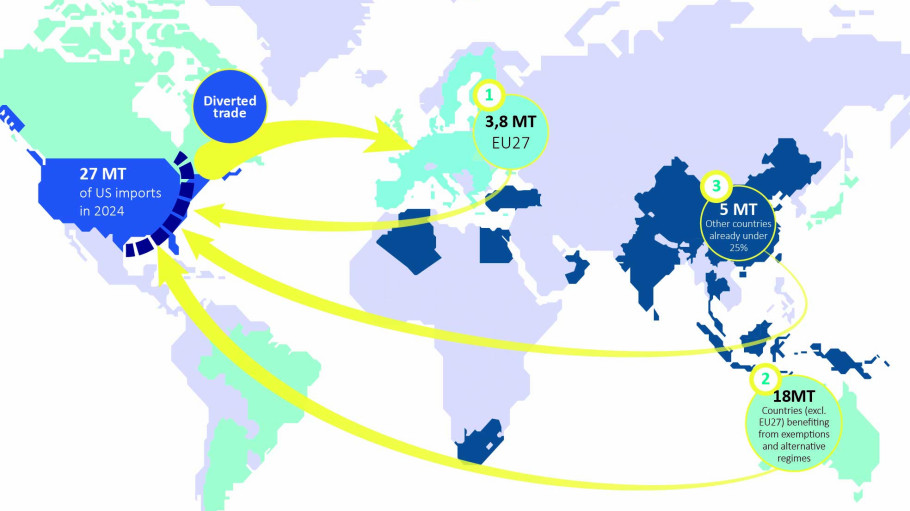

Brussels, 11 July 2025 – The delay and ongoing uncertainty about a deal on tariffs between the EU and the U.S. further worsens the crisis for the European steel industry. U.S. steel tariffs at 50% are adding fuel to an already explosive situation, putting the sector at risk of losing all its exports to the U.S. and facing a surge of deflected trade flows redirected from the U.S. to the EU market. The lack of bold and timely implementation of the Steel and Metals Action Plan is further accelerating the sector’s deterioration, says the European Steel Association.

“We cannot continue with U.S. steel tariffs at 50%. As we lose our major export market, the European market is being flooded by the steel the U.S. is no longer absorbing. We are particularly disappointed by the absence of a joint EU-U.S. approach preserving EU steel exports to the U.S. and tackling trade diversion towards the EU on top of massive global overcapacity — now 5 times larger than the EU’s total steel production. This glut is destroying entire value chains, undermining industrial resilience, defence capabilities and the green transition”, said Dr Henrik Adam, President of the European Steel Association (EUROFER).

“What is even more concerning is that while the U.S. — regardless of the administration — has consistently pursued a bold industrial strategy, the EU has fallen behind. The implementation of the Steel and Metals Action Plan has yet to deliver tangible results. Any potential benefits from the last EU steel safeguard review have been entirely wiped out due to its low level of ambition and the disastrous impact of the U.S. tariffs, which is only beginning to materialise”, added Dr Adam.

Benefitting from lower energy costs, green subsidies, Buy U.S. steel policy and strong trade protection with the reactivation of steel tariffs, the U.S. steel industry first regained price competitiveness versus imports, and then has invested in 8-9 million tonnes of new capacity. The increase to 50% blanket tariffs is now expected to further boost U.S. domestic capacity utilisation securing volumes for newly built production lines by reducing imports and ramping up domestic output. In stark contrast, the EU lost 10 million tonnes of capacity in 2024 alone — its highest annual closure rate ever. Before the 50% tariff hike, the EU was the third-largest exporter to the U.S. after Canada and Brazil, accounting for around 4 million tonnes of steel exports.

Meanwhile, EU policy responses fall short. The Affordable Energy Action Plan and the Clean Industry State Aid Framework have not delivered substantial energy price relief for energy-intensive industries. The root cause — the EU’s electricity market design, which continues to deliver uncompetitively high prices — remains unaddressed, despite being central to the Draghi report.

The most important initiatives of the Steel and Metals Action Plan are expected only after summer: in September, the new ‘highly effective trade measure’ to replace the current safeguard to protect EU steel capacities, and by December, a proposal to close major loopholes in the Carbon Boarder Adjustment Mechanism (CBAM) – including resource shuffling and also export leakage, which has already been delayed.

“The game changer for a business case in Europe is not there yet. If these key measures on trade and CBAM are addressed by the European Commission as half-heartedly as energy prices, we will inevitably continue to see more capacity closures, job losses, and stalled decarbonisation projects. If that happens, there will only be losers: EU steel producers wiped out by cheap, carbon-intensive imports, and an EU transition and climate ambition that falter without solid industrial foundations”, concluded Dr Adam.

Contact

Lucia Sali, Spokesperson and Head of Communications, +32 2 738 79 35, (l.sali@eurofer.eu)

About the European Steel Association (EUROFER)

EUROFER AISBL is located in Brussels and was founded in 1976. It represents the entirety of steel production in the European Union. EUROFER members are steel companies and national steel federations throughout the EU. The major steel companies and national steel federation of Turkey, Ukraine and the United Kingdom are associate members.

The European Steel Association is recorded in the EU transparency register: 93038071152-83.

About the European steel industry

The European steel industry is a world leader in innovation and environmental sustainability. It has a turnover of around €215 billion and directly employs around 298,000 highly-skilled people, producing on average 146 million tonnes of steel per year. More than 500 steel production sites across 22 EU Member States provide direct and indirect employment to millions more European citizens. Closely integrated with Europe’s manufacturing and construction industries, steel is the backbone for development, growth and employment in Europe.

Steel is the most versatile industrial material in the world. The thousands of different grades and types of steel developed by the industry make the modern world possible. Steel is 100% recyclable and therefore is a fundamental part of the circular economy. As a basic engineering material, steel is also an essential factor in the development and deployment of innovative, CO2-mitigating technologies, improving resource efficiency and fostering sustainable development in Europe.

Brussels, 26 February 2026 — Europe’s steel industry has warned that the current draft Industrial Accelerator Act could direct public support for low-carbon steel to producers outside the European Union, unless lawmakers include and tighten ‘Made in Europe’ provisions.

Brussels, 24 February 2026 - Europe’s energy-intensive industries have set out a series of proposals to ensure that the EU’s upcoming Electrification Action Plan delivers on its objectives to stimulate and boost electricity consumption in industry. In a joint position paper, industries warn that persistently high electricity prices risk undermining industrial competitiveness and decarbonisation efforts. They call for a policy framework that will enable EU industry in pursuing decarbonisation and industrial competitiveness.

Energy-intensive industries (EIIs) provide direct employment to around 2.6 million people in the EU and represent the foundations of critical and strategic value chains for the EU economy and society. The current economic and energy outlook of the European Union is making investments in electrification and the continued business operation of our sectors at serious risk, should the energy-cost challenge not be solved.